Your Texas Property Tax Solution

Do-It-Yourself Texas Property Tax Appeals

We're Closing

After much consideration, the three guys running Jubally Solutions will be retiring after the 2025 property tax season. Thank you to all of our customers throughout the years. It has been an honor working against the scam of property taxes with you.

Any requests for refunds must be submitted by November 1st, 2025. Any requests made after that date will not be considered.

Available For Purchase

Jubally is also available for purchase. To make inquiries, please use the Contact Us form.

How It Works

Jubally performs an analysis of your neighborhood to find acceptable comparisons for your property based on age, size, quality, and several other metrics. We then calculate the lowest possible value we can and generate a PDF report for you to use at your hearing.

APPRAISAL VALUE

$390,000

- $342,691

ADJUSTED VALUE

$367,244

Save Time and Frustration

Find Comparisons Algorithmically

Compound Savings

When you protest your property’s value even once it can create lasting savings that compound year after year. The more often you protest your property’s value the more you can save.

Unprotested vs Protested

Taxes Over 10 Years

Undisputed Property Taxes

Paid over 10 year period

$138,398

Disputed Property Taxes

Paid over 10 year period

$129,969

Real Dollar Savings

$8,429.11 See the Math

This chart assumes a starting evaluation of $350,000 in a county with a 3% property tax rate. It assumes a yearly increase in evaluation of 6%, and a protest reduction of ONLY $5,000 each year.

Protesting 101

The video below covers the most common questions and concerns when protesting your property taxes and shows how Jubally Solutions can help you.

Empowering Texans

to Save Their Income

Feature Packed!

DIY Property Tax Evidence

Property taxes are designed to be confusing and difficult to dispute. We cover as much of the process as we can so you save time and money.

-

Thorough Comparisons Report

- Our reports show all the best comparison properties in your neighborhood and the math to prove your case.

-

Free Analysis

- You can see if we can generate a good value for your property before ever buying.

-

Free Protest Form

- We'll generate an Intent to Protest form for free, even if you don't buy a report.

-

Instructions for Your Hearing

- We provide instructions on what a hearing looks and sounds like, and how to represent yourself before appraisers.

-

Money Back Guarantee

- Our reports are backed by a guarantee that if the county doesn't lower the market value with our data, we will refund your purchase. (Market Value Only, we can't legally dispute an Appraised Value.)

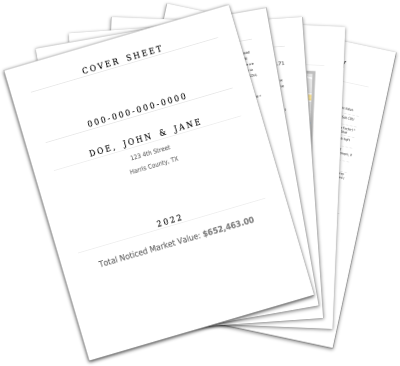

See the Reports!

Our reports generate with all the data you need for a hearing. Proper comparisons with all the math to prove that your property is over-valued by the county. This is just a small sample.

Download a Sample Report

This report has been annonymized, but all the math is still real and the report is exactly as appears in the real product.

Download Sample